国产不卡视频一区二区三区,欧美日韩在线视频,成全免费高清大全,国产精品久久毛片

江西銀行:十大關聯客戶風險敞口396.77億,房地產不良率猛漲至17.81%

獨家搶先看

近日,江西銀行對外公布了2024年業績報告。報告顯示,該行在過去一年實現營收115.59億元,同比微增2.32%;凈利潤為10.98億元,同比微增2.21%。盡管營收和凈利潤有所增長,但多項關鍵指標卻透露出江西銀行面臨的挑戰。

從盈利能力來看,江西銀行的稅前利潤僅7.52億元,同比下滑25.54%。凈利潤的增長主要得益于高達3.45億元的所得稅抵免,該行解釋稱這主要是因為“持有國債和地方債利息收入等符合稅法規定的免稅收益增加”。這意味著,剔除這一特殊因素,江西銀行的盈利能力實際上有所減弱。

盈利能力不佳的背后,資產減值損失問題也不容忽視。2024年江西銀行當期計提資產減值損失為73.76億元,較上年同期增加7.12億元,變動率達到10.68%。對此,該行稱:“以預期信用損失模型為基礎,基于客戶違約概率、違約損失率等風險量化參數,結合宏觀前瞻性的調整,計提信用風險損失準備。”而這也表明銀行在資產質量管控上壓力不小,需要撥備更多資金來應對潛在風險。

從資產規模與貸款業務數據來看,截至 2024 年末,江西銀行總資產達 5736.35 億元,同比增長 3.85%;吸收存款 3909.32 億元,發放貸款及墊款凈額為 3420.88 億元,增幅達 5.09%。然而,貸款質量方面的隱憂不容忽視。數據顯示,該行不良貸款余額增至 75.88 億元,較 2023 年末增加 2.89 億元;盡管不良貸款率較上年底微降 0.02 個百分點至 2.15%,但仍顯著高于 2024 年四季度 1.5% 的同業平均水平 。進一步分析行業數據,江西銀行部分行業不良率偏高。服務業不良率3.34%,批發和零售行業不良率為7.66%, 房地產貸款不良率高達17.81%。

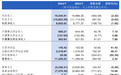

客戶風險暴露問題同樣嚴峻。截至 2024 年 12 月 31 日,十大非同業單一客戶風險暴露余額總計 275.89億元,占貸款總額比例為 7.81% ,占一級資本凈額的比例達 56.60%;其中,最大單一客戶(借款人 A,租賃和商務服務業)風險暴露余額為 34.28 億元,占一級資本凈額比例為 7.03%,逼近監管紅線。十大非同業關聯客戶風險暴露余額總計 396.77 億元,占貸款總額比例為 11.24% ,占一級資本凈額比例高達 81.39% 。

聯合資信在其評級報告中指出,江西銀行信貸資產規模保持增長,截至2024年末,江西銀行單一最大客戶貸款和最大十家客戶貸款占一級資本凈額的比例分別為7.03%與56.60%,面臨一定的客戶集中風險,前十大客戶主要分布在租賃與商務服務業、建筑業、金融業等。此外,批發零業的小微企業和個體工商戶償債壓力大,加之,受房地產調控政策的影響,部分房企經營惡化,對江西銀行信貸資產質量造成一定沖擊。

風險指標和資本狀況也不容樂觀。江西銀行撥備覆蓋率160.15%,較上年底減少17.11個百分點,處于近5年的低點;核心一級資本充足率、一級資本充足率、資本充足率均較上年底有所下滑,降幅分別為0.07%、0.06%、0.08%。

江西銀行成立于2015年12月,前身為南昌銀行,2018年6月在香港上市,營業機構覆蓋江西省并在省外設有分行,還發起設立了金融租賃公司和村鎮銀行。

來源:金融界